What is a Copay?

In an attempt to simplify the way people use and understand their health insurance plans, carriers and employers often include fixed payment amounts for very specific services. These fixed amounts, called copayments or copays for short, are typically used for common medical services.

Things like:

- primary care visits,

- specialist visits,

- urgent care visits,

- emergency room visits,

- physical therapy, or

- prescription drugs.

Sometimes, copays are used from the first dollar you spend as coverage. Other times, you must meet a deductible BEFORE copays kick in. And sometimes, services are listed with a $0 copay!

How’s that for confusing?

Fear not, I’ll show you some typical plan designs and explain all this stuff. Remember, for your own health plan, you should DEFINITELY call the Customer Service number on the back of your insurance card to understand how your specific benefits work and what you could pay for services.

When and Why You Pay a Copay

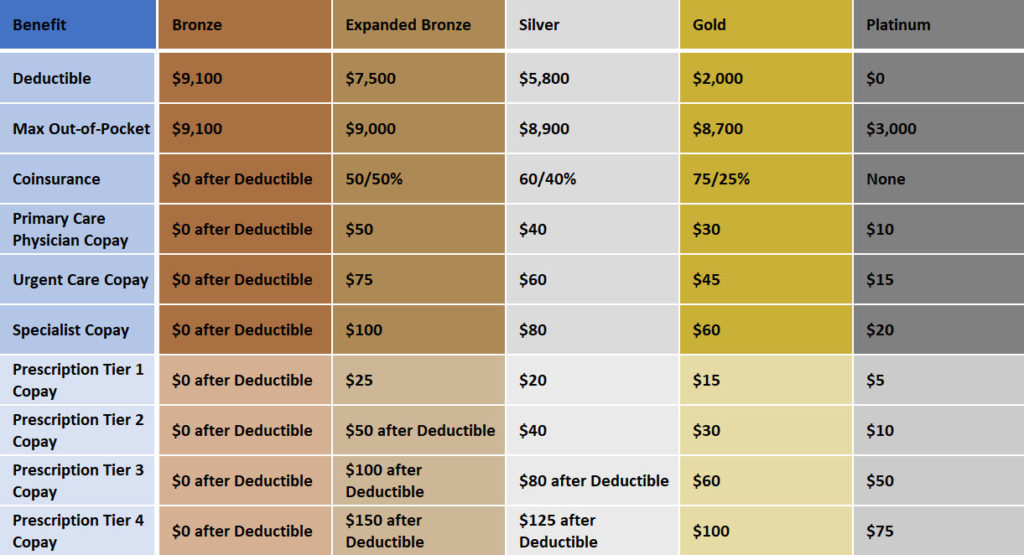

I like visual explanations. So to help us understand how copays fit in, here are some benefits of standard plan designs the federal government is using on healthcare.gov for 2023. These have coinsurance and copays working together.

Notice in this grid as you move right and select a plan with a higher premium, the copays get smaller. This grid shows seven typical copay-type services. But the true, federally specified, standard ACA health plan you would purchase on healthcare.gov is actually required to cover up to 16 services with a copay! That would be a lot to remember, which is another good reason to keep your insurance card and Customer Service phone number close by.

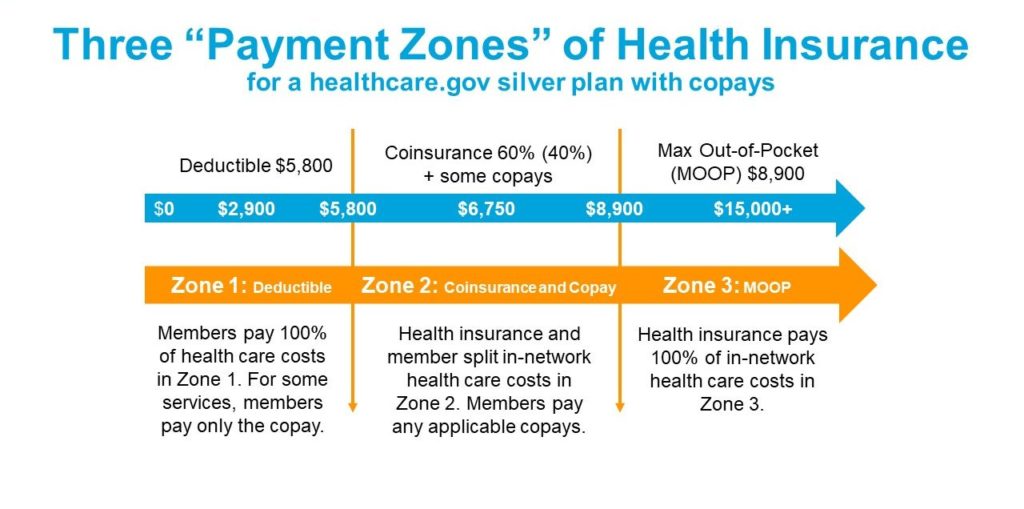

If there is a gap between your deductible and your max out-of-pocket costs, you may have a co-insurance for other services. Depending on your plan, that might be a hospital visit, imaging or durable medical equipment. If you have any questions, look at your plan’s summary of benefits and coverage (your health insurance provider can provide this) and your explanation of benefits. You can also call the customer service phone number on your ID card to ask specific questions.

While some copays are just a straight dollar amount, it’s worth noticing that others require that you meet your deductible BEFORE you can start buying those services at copay prices.

In Which Zones Do Copays Fall?

$0 Copays – The ACA gave lots of money and authority to a non-governmental agency called the United States Preventive Services Task Force (USPSTF) and asked them to research every potential wellness treatment, medication, testing and counseling session. Their task was to determine which of those would be valuable to include in your health insurance. The ACA then specified that USPSTF-recommended services would be covered without regard to your deductible status at a $0 copay. That meant if you received these services within your plan network, they’d be free! So when you get your age- and gender-appropriate testing like PAP smears, mammograms, prostate exams, colonoscopies and the like, they are covered from the first dollar, with $0 copays for you, the patient. This $0 coverage applies to over 50 services covered on your health plan, including contraceptives. The ACA greatly expanded the use of $0 copays, and it continues today.

All Copay Plans – The notion of simple fixed costs for many common health care services has become so popular among folks who buy health insurance that carriers have started designing plans with copays for nearly everything, from a PCP visit to prescription drugs to inpatient hospital stays! These plans typically don’t have deductibles (for in-network services) or coinsurance. They simply have a max out-of-pocket amount with lots of copays underneath. This is pretty new, and I am very curious to see how the market will react to the simplicity and clarity of an “all copay” plan.

High-Deductible Health Plans – Are there exceptions to every rule? You bet. About 20 years ago, the federal government came up with a simple idea: If you create a financial savings account that people can use when they select a federally designed plan with a higher deductible, they would get a much better view of how much their health care REALLY cost and become better consumers. While that might not have worked out the way they planned, many people today get high-deductible health plans (HDHP) from their employers. Do these have copays?

Kind of. You see, an HDHP is required by law to offer an insured person the same USPSTF coverage mentioned above with the 50-ish different wellness services and treatments at $0 copay (in-network) at the appropriate age and gender. Other than that, HDHPs are not allowed to offer copays for regular services like doctor or specialist visits. Until…

The IRS decided recently that insulin for diabetics was SO important that a special copay before the deductible SHOULD be allowed. So now, employers and insurance carriers offering HDHPs can have a pre-deductible copay for insulin only. That’s a new interpretation, and we don’t know yet if carriers will take up the idea. So far, it is optional for employers and their insurance companies.

Written by: Mike Bertaut, Blue Cross Blue Sheild of LA, Straight Talk (Sept. 2022)